Dr Zongyuan Li

Lecturer in Financial Economics and Technology

J.E. Cairnes School of Business and Economics, University of Galway

Zongyuan is Lecturer in Financial Economics and Technology (Assistant Professor) at the J.E. Cairnes School of Business and Economics. His research centers on two main areas: (1) the impact of government regulation and political shocks on highly regulated industries, particularly banks and real estate firms, and (2) the strategies firms use to bypass regulations and public oversight. Recently, he has also been incorporating the impact of climate risk into his work, broadening the scope of his research.

His work contributes to maintaining financial stability, a cornerstone of sustainable economic growth (SDG 8), and directly addresses issues of financial inclusion and reducing inequality (SDG 10).

Zongyuan's work contribute to these SDGs

1. Promote financial literacy through teaching and research initiatives focused on underserved communities.

2. Develop and implement finance-related curricula that prepare students to make informed and responsible financial decisions

Aim of the Work

Strengthen Financial System Stability

Promote Financial Inclusion

Reduce Mitigate Inequality

Financial Stability & Fintech Regulation:

Li, Z., Li, J., Chang, X. (2024). Market uncertainties and too-big-to-fail perception: Evidence from Chinese P2P registration requirements. Journal of International Financial Markets, Institutions and Money,95, 102032.

Eliminate Inequality:

Chang, X., Li, J., Li, Z. (2022). Revisit the Nexus between Saving and Inequality in Labor Intensive Economies: Evidence from China. Emerging Markets Finance and Trade,58(14) 4091-4102

Teaching

(EC5104) Applied Portfolio Management

This module covers key areas such as asset allocation, diversification, and modern risk management techniques to optimise portfolio performance.

Focusing on Targets:

SDG 8: This module contributes to economic growth by optimising investment strategies across various asset classes.

SDG 9: The application of advanced modelling techniques promotes innovation in the financial sector.

(EC5147) Financial Technology and Economics

This module aims to provide a comprehensive understanding of the transformative impact of financial technology (fintech) on the financial sector and the broader economy.

Supporting Targets:

SDG 8: This module focus on how fintech is transforming the financial industry

and creating new economic opportunities.

SDG9: This module also focus on how fintech is transforming the financial industry

and creating new economic opportunities.

SDG 17: This module shows how fintech is transforming the financial industry and creating new economic opportunities.

Engagement

Actively contribute to enhancing financial literacy among college students by participating in activities organized by the CFA Institute and its regional societies.

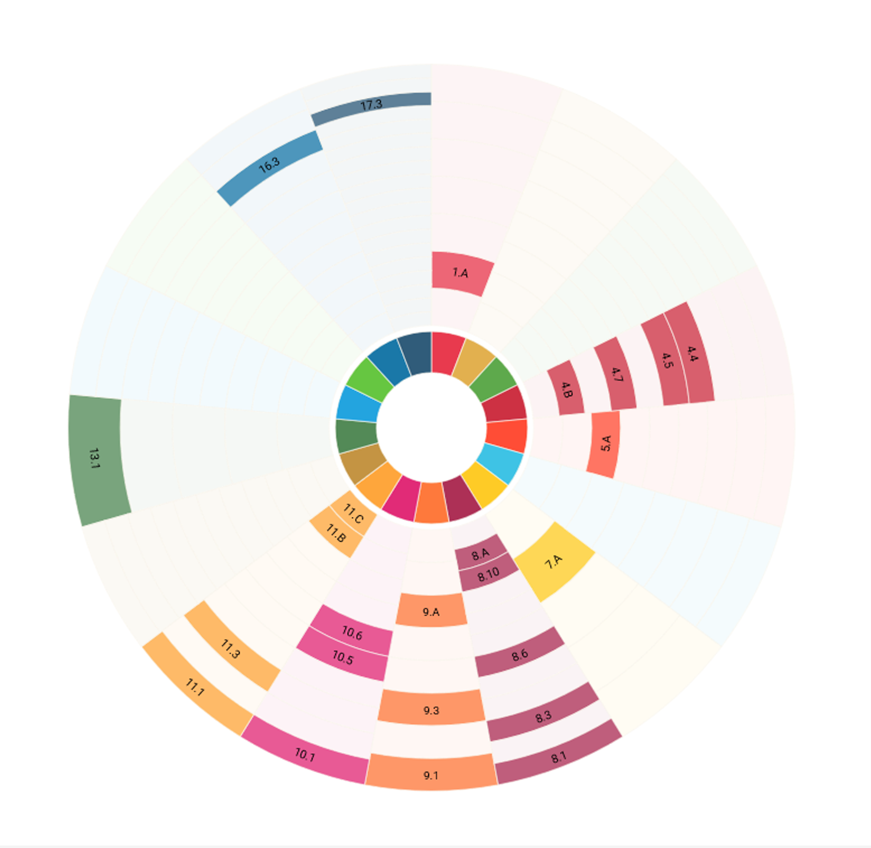

Direct impact SDG Targets

?

Indirect SDG Targets

1.A - Mobilize resources to implement policies to end poverty

4.4 - Increase the number of people with relevant skills for financial success

4.5 - Eliminate all discrimination in education

4.7 - Education for sustainable development and global citizenship

4.B - Expand higher education scholarships for developing countries

5.A - Equal rights to economic resources, property ownership and financial services

7.A - Promote access to research, technology and investments in clean energy

8.1 - Sustainable economic growth

8.3 - Promote policies to support job creation and growing enterprises

8.6 - Promote youth employment, education and training

8.10 - Universal access to banking, insurance and financial services

8.A - Increase aid for trade support

9.1 - Develop sustainable, resilient and inclusive infrastructures

9.3 - Increase access to financial services and markets

9.A - Facilitate sustainable infrastructure development for developing countries

10.1 - Reduce income inequalities

10.5 - Improved regulation of global financial markets and institutions

10.6 - Enhanced representation for developing countries in financial institutions

11.1 - Safe and affordable housing

11.3 - Inclusive and sustainable urbanization

11.B - Implement policies for inclusion, resource efficiency and disaster risk reduction

11.C - Support least developed countries in sustainable and resilient building

13.1 - Strengthen resilience and adaptive capacity to climate related disasters

16.3 - Promote the rule of law and ensure equal access to justice

17.3 - Mobilize financial resources for developing countries

Research

Featured Publications

1. Conduct high-quality research on strengthening the stability of the financial system, offering policy implications for regulators and supporting long-term sustainable growth.

2. Continue exploring the factors contributing to inequality, providing potential policy implications and suggestions.

3. Expand research on how financial markets can mitigate climate risk, with the aim of delivering actionable policy implications.

|

References |

SDGs |

|

SDG 8| SDG 10 |

|

|

SDG 8 |

|

|

SDG 8 |

|

|

Interbank borrowing and bank liquidity risk, Journal of Financial Research, 45(1), 53-91. |

SDG 8 |

|

SDG 1| SDG 10 |

|

|

SDG 11 |