Dr Rehman Uddin Mian

Lecturer in Accountancy & Finance

J.E. Cairnes School of Business and Economics, University of Galway

Rehman's research interests primarily focus on the monitoring role of foreign institutional investors in corporate strategic decisions worldwide, alongside institutional investor activism and ESG considerations.

Rehman has contributed to publications in peer-reviewed journals of international repute including the International Review of Financial Analysis, Economics Letters and the International Journal of Managerial Finance.

Rehman is an active member of the Japan Finance Association and has a background as a former Japanese MEXT Research Fellow. He completed his PhD at the Tokyo Institute of Technology in 2016, having previously served as a Research Student at Hitotsubashi University until 2012. Before joining the J.E. Cairnes School of Business & Economics in 2024, he held the position of Assistant Professor of Finance & Investment at NUST Business School from July 2016 to February 2024.

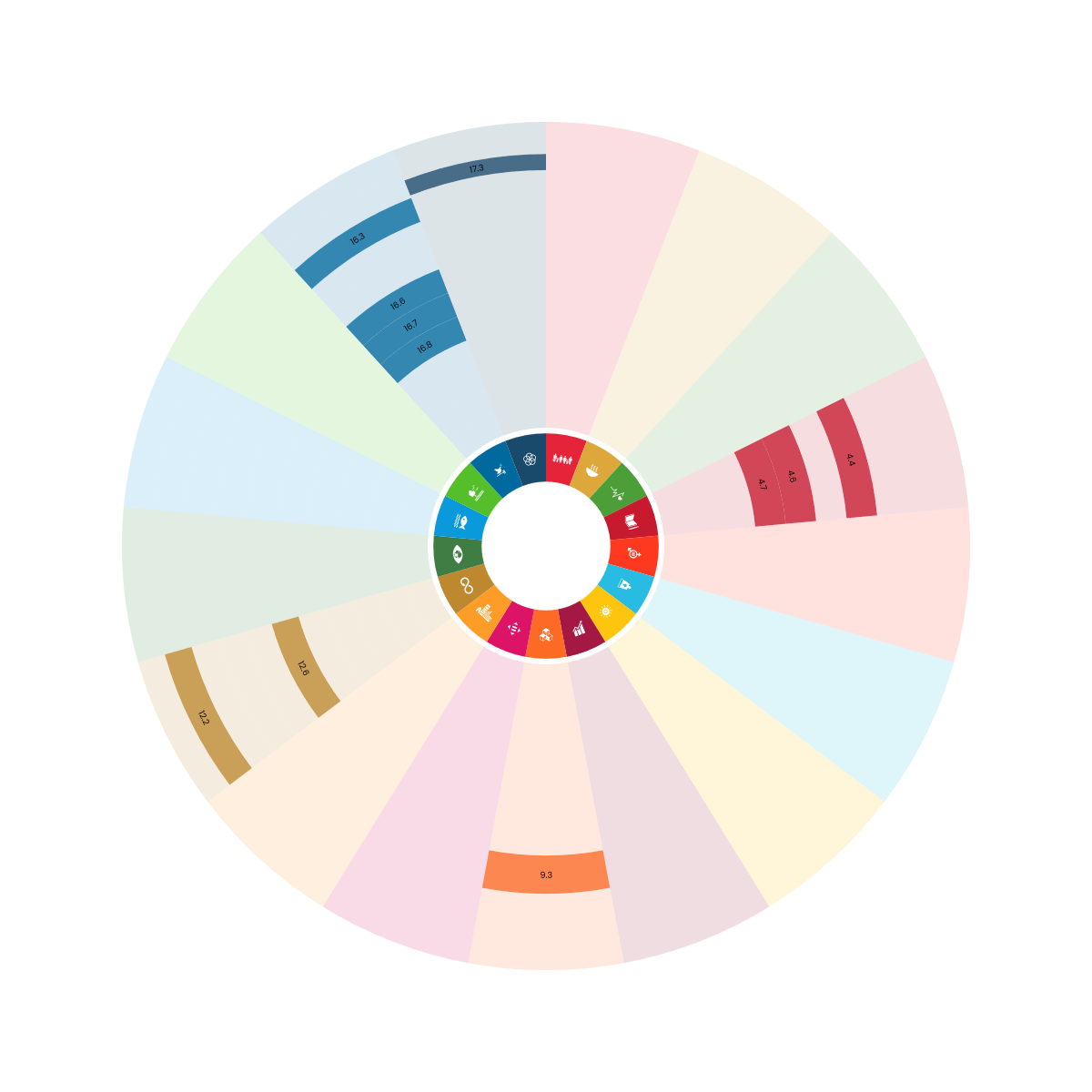

Rehman's work contributes to these SDGs

Rehman's research centres on studying various dimensions related to the effectiveness of monitoring by foreign institutional investors in corporate strategic decisions around the world. His research explores multifaceted aspects of foreign institutional monitoring, including investment horizon, activism, economic weights within cross-border portfolios, and governance quality in the home countries of foreign investors.

Key Target 16.6 Develop effective, accountable and transparent institutions

Teaching

AY5104 Investment and Financing Decisions

The module will increase students' knowledge of the role of corporate finance theory and practice in both investment and financing decisions at an organisational level. In particular, students will explore how various corporate finance techniques and tools support both capital-investment appraisals and finance-sourcing decisions. Furthermore, the module will enable students to apply judgement and insight to the evaluation of these strategic financial decisions.

Supporting Targets: 4.4 Increase the number of people with relevant skills for financial success, 4.6 Universal literacy and numeracy, 4.7 Education for sustainable development and global citizenship

AY 5108 Intermediate Corporate Finance

The objectives of this module are to facilitate students in developing and applying a comprehensive understanding of the role of corporate finance in investment and financing decision-making, especially the analysis of complex structured and unstructured decision situations in a strategic context. The module explores the role of finance theory and corporate finance tools and techniques in supporting the strategic capital investment and financing decision-making processes in an organisation.

Supporting Targets: 4.4 Increase the number of people with relevant skills for financial success, 4.6 Universal literacy and numeracy, 4.7 Education for sustainable development and global citizenship

Direct impact SDG Targets

4.4 - Increase the number of people with relevant skills for financial success

4.6 - Universal literacy and numeracy

4.7 - Education for sustainable development and global citizenship

9.3 - Increase access to financial services and markets

Indirect

12.2 - Sustainable management and use of natural resources

12.6 - Encourage companies to adopt sustainable practices and sustainability reporting

16.3 - Promote the rule of law and ensure equal access to justice

16.6 - Develop effective, accountable and transparent institutions

16.7 - Ensure responsive, inclusive and representative decision-making

16.8 - Strengthen the participation in global governance

17.3 - Mobilize financial resources for developing countries

Research

Featured Publications

|

References |

SDGs |

|---|---|

|

Ilyas, M., Mian, R. U., Suleman, M. T. (2022). Economic policy uncertainty and firm propensity to invest in corporate social responsibility. Management Decision, 60(12), 3232-3254. |

12 |

|

Ilyas, M., Mian, R. U., Safdar, N. (2022). Institutional investors and the value of excess cash holdings: Empirical evidence from Pakistan. Managerial Finance, 48(1), 158-179. |

16 |

|

Mian, R. U., Irfan, S., Mian, A. (2023). Foreign institutional investment horizon and earnings management: Evidence from around the world. International Review of Financial Analysis, 86. |

17 |

|

Mian, R. U., Mian, A., Safdar, N. and 1 more (...) (2022). Cross-border spillover of institutional activism: The monitoring role of locally-aggressive foreign institutional investors. Finance Research Letters, 46. |

17 |

|

Ilyas, M., Mian, R. U., Mian, A. (2023). Foreign institutional investors and the value of excess cash holdings: International evidence. International Journal of Accounting and Information Management, 31(5), 705-725. |

16 |

|

Rahim, I., Mian, R. U., Mian, A. (2024). Country-level heterogeneity in foreign institutional investment horizons and firm value. International Review of Financial Analysis, 92. |

17 |

|

Mian, R. U., Mian, A. (2023). Foreign institutional investment horizon and investment efficiency in emerging markets. Economics Letters, 232. |

9 |

|

Ilyas, M., Mian, R. U., Mian, A. (2023). International evidence on the monitoring role of foreign institutional investors in corporate investment efficiency. International Journal of Managerial Finance. |

16 |